Why VCs in UAE Hate Long Sales Cycles (And What to Do About It)

VCs Don’t Just Want Growth—They Want Speed ⏩

Startups don’t just need to grow. They need to grow fast.

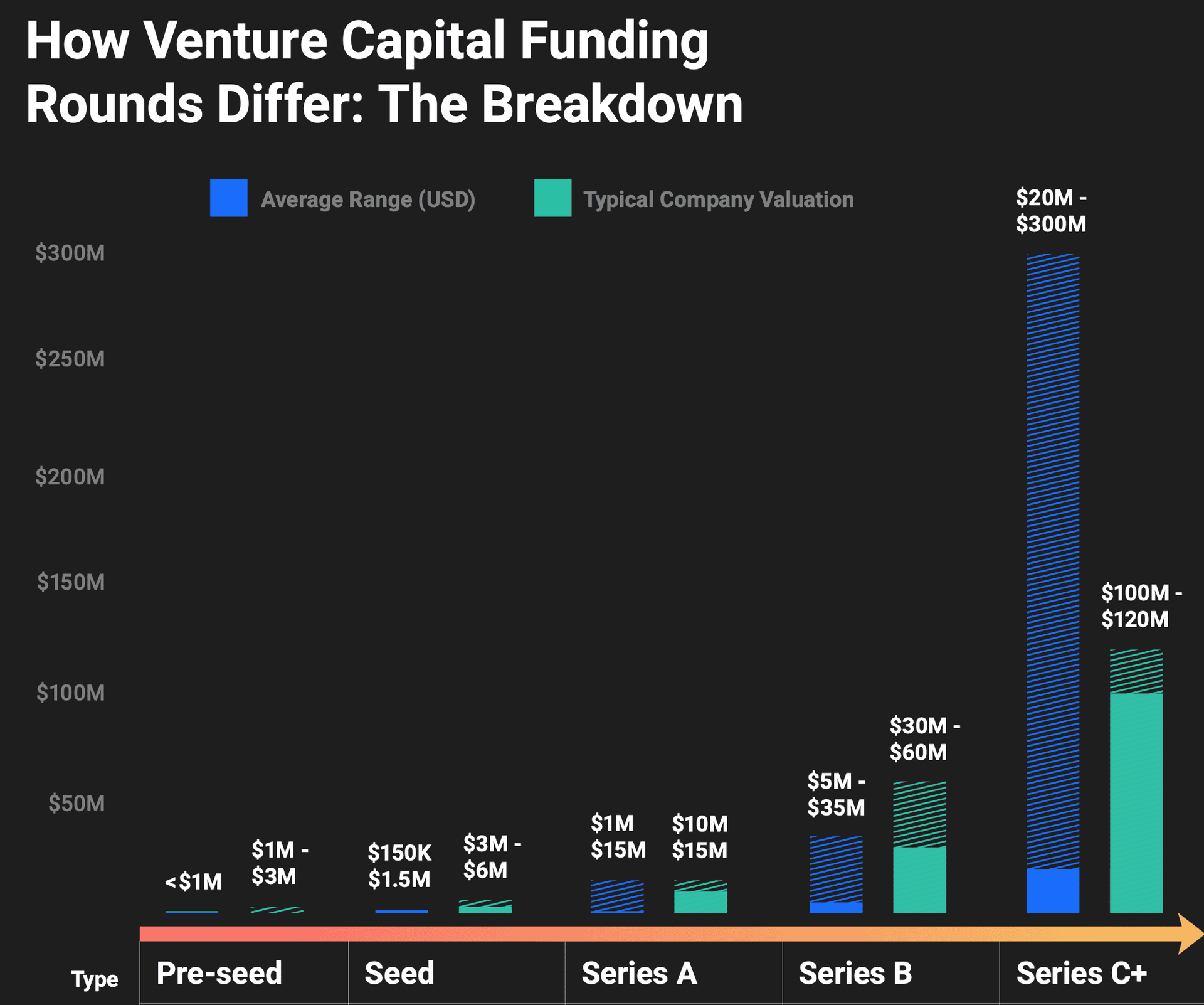

VCs invest in companies that can hit $100M (~AED 360-400M) revenue in 5-6 years.

If you can’t scale like that fast, you’re not VC-fit. And here are perfectly fine businesses that can grow without VC money. But if you want VC money, then remember:

Slow Sales = No VC Money ❌

VCs operate on 8-10 year fund cycles. They don’t have time for slow-moving startups.

A long sales cycle means:

⚠️ Fewer deals closed per year

⚠️ Slower revenue growth

⚠️ Less money to reinvest into scaling

The faster you convert leads into paying customers, the more attractive you are to investors.

How to Keep Sales Cycles Short 🎯

Successful startups solve real pain points:

💰 Help someone Make money (Shopify)

💸 Help companies Save money (Ramp)

⏳ Help companies Save time (Zapier)

If you don’t solve big problems for your customers, growth will be slow.

Other factors that kill sales speed:

🚧 Target Customers are locked into contracts

🛑 Too many competitors = hard to differentiate

🤝 Too many decision-makers involved (B2B software)

Want VC Money? Fix Your Sales Cycle 💡

To speed up sales and attract investors:

✅ Target the right audience (those ready to buy)

✅ Solve a clear pain point (not a “nice-to-have”)

✅ Differentiate your product (stand out in the market)

✅ Refine your sales process (streamline lead-gen → closing)

VCs bet on fast-moving, scalable startups.

If your sales cycle drags, they’ll pass.