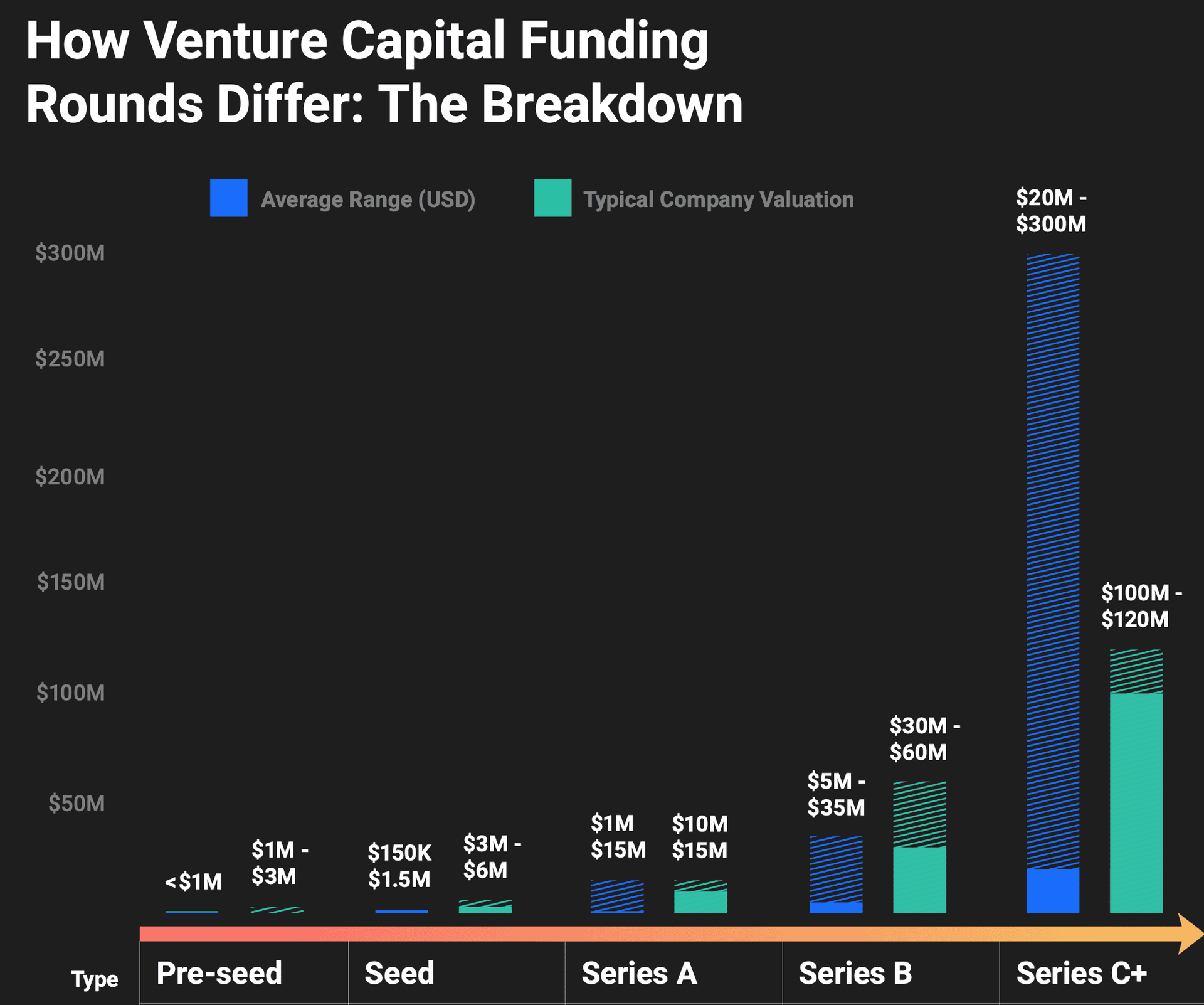

Dubai Founders: Raising funds? read this before you start!

Here's your quick guide to startup fundraising stages:

🚀 𝗣𝗿𝗲-𝘀𝗲𝗲𝗱

Typical Raise: $50K - $500K

Investors: Friends & family, early-stage angels, startup accelerators

Use of Funds: Building prototypes, hiring core team, validating ideas

Stage: Pre-product, conceptual

🌱 𝗦𝗲𝗲𝗱

Typical Raise: $500K - $2M

Investors: Angel investors, early-stage VCs, accelerators

Use of Funds: Achieving product-market fit, initial traction, product development

Stage: Early traction, initial product validation

📈 𝗦𝗲𝗿𝗶𝗲𝘀 𝗔

Typical Raise: $2M - $15M

Investors: Venture capital firms, super angels

Use of Funds: Scaling revenues, enhancing marketing and sales processes, deeper customer insights

Stage: Proven market traction, revenue-generating, growth stage

⚡ 𝗦𝗲𝗿𝗶𝗲𝘀 𝗕

Typical Raise: $15M - $50M

Investors: Late-stage venture capital firms

Use of Funds: Significant scaling, expanding market segments, developing new revenue streams, senior hires

Stage: Expansion stage, substantial growth

🏢 𝗦𝗲𝗿𝗶𝗲𝘀 𝗖 𝗮𝗻𝗱 𝗯𝗲𝘆𝗼𝗻𝗱 (𝗦𝗲𝗿𝗶𝗲𝘀 𝗖+)

Typical Raise: $50M+

Investors: Late-stage VCs, private equity firms, hedge funds, banks

Use of Funds: Large-scale operations, market expansion, acquisitions

Stage: Mature, scaling into new markets, acquisition-focused

Knowing when and from whom to raise money—and how best to deploy it—can define the success trajectory of your startup.

What funding stage are you currently navigating, and what's your biggest challenge right now?

ht/:

Crunchbase report